SaaS platform powered by AI and ML is aimed at making risk management in lending effective and hassle-free. GiniMachine builds, validates, and deploys credit risk models using your company’s historical data. It takes seconds or minutes to reveal hidden dependencies, compare and make informed business decisions.

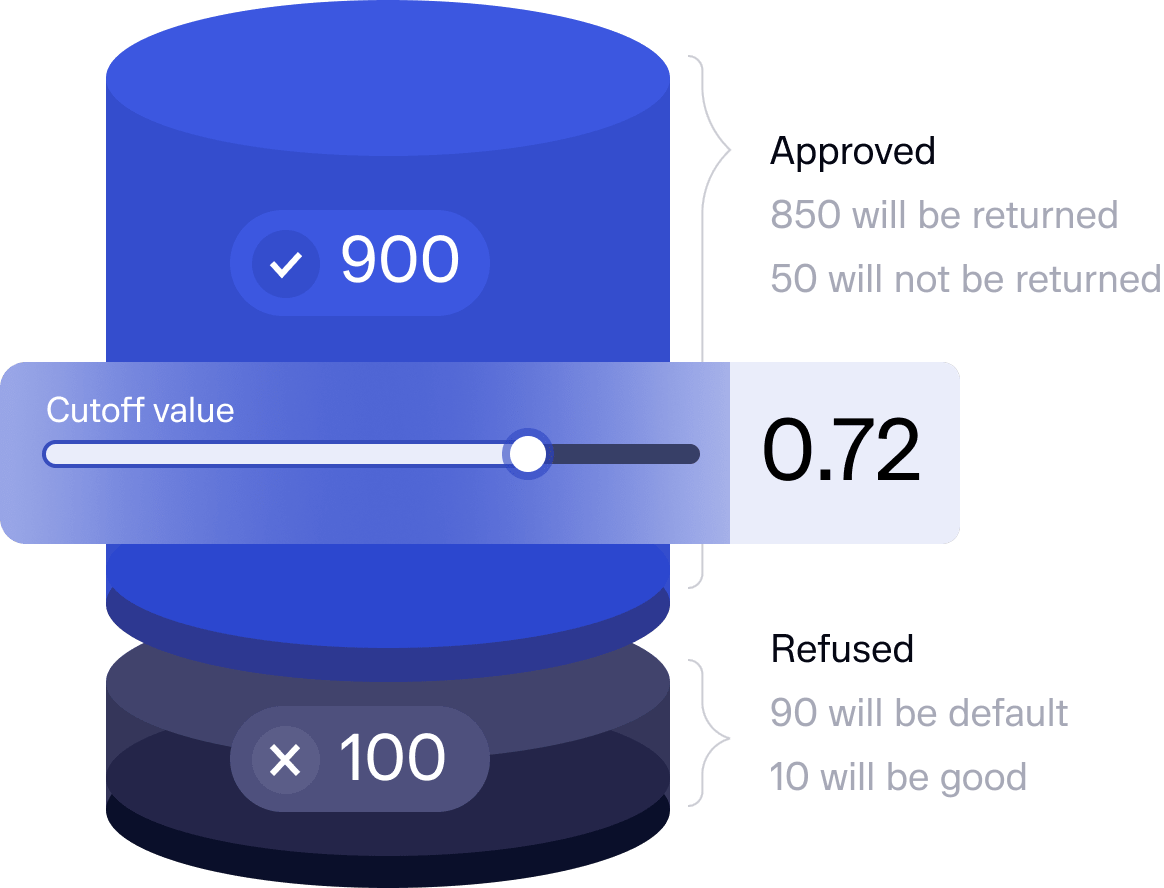

Banks and financial institutions may lack risk management software that helps prioritize debtors with a higher payback probability. Empowered by AI, GiniMachine deals with scoring. It makes reliable predictions and analyzes collection tools to select the most effective ones for each case.

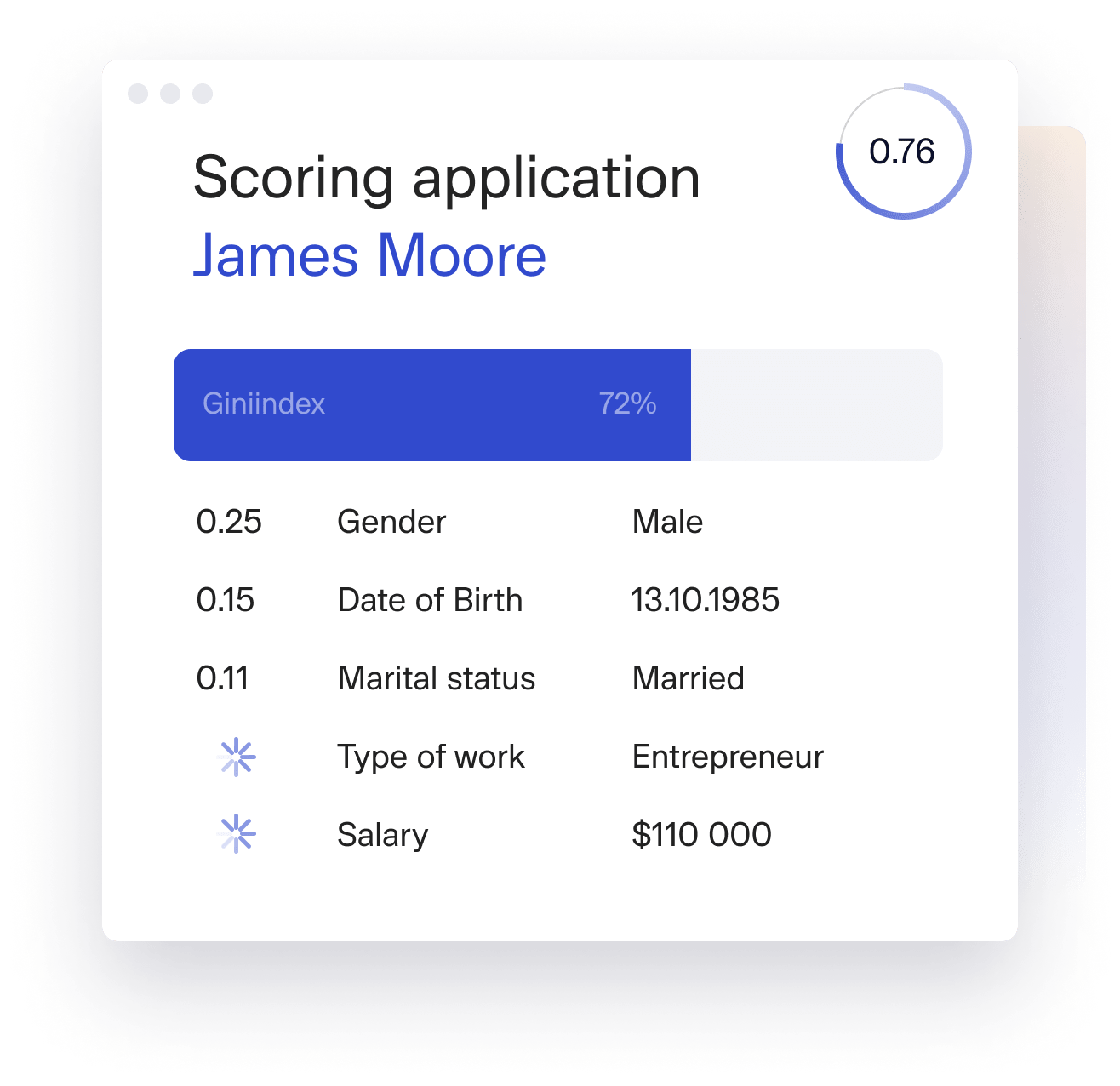

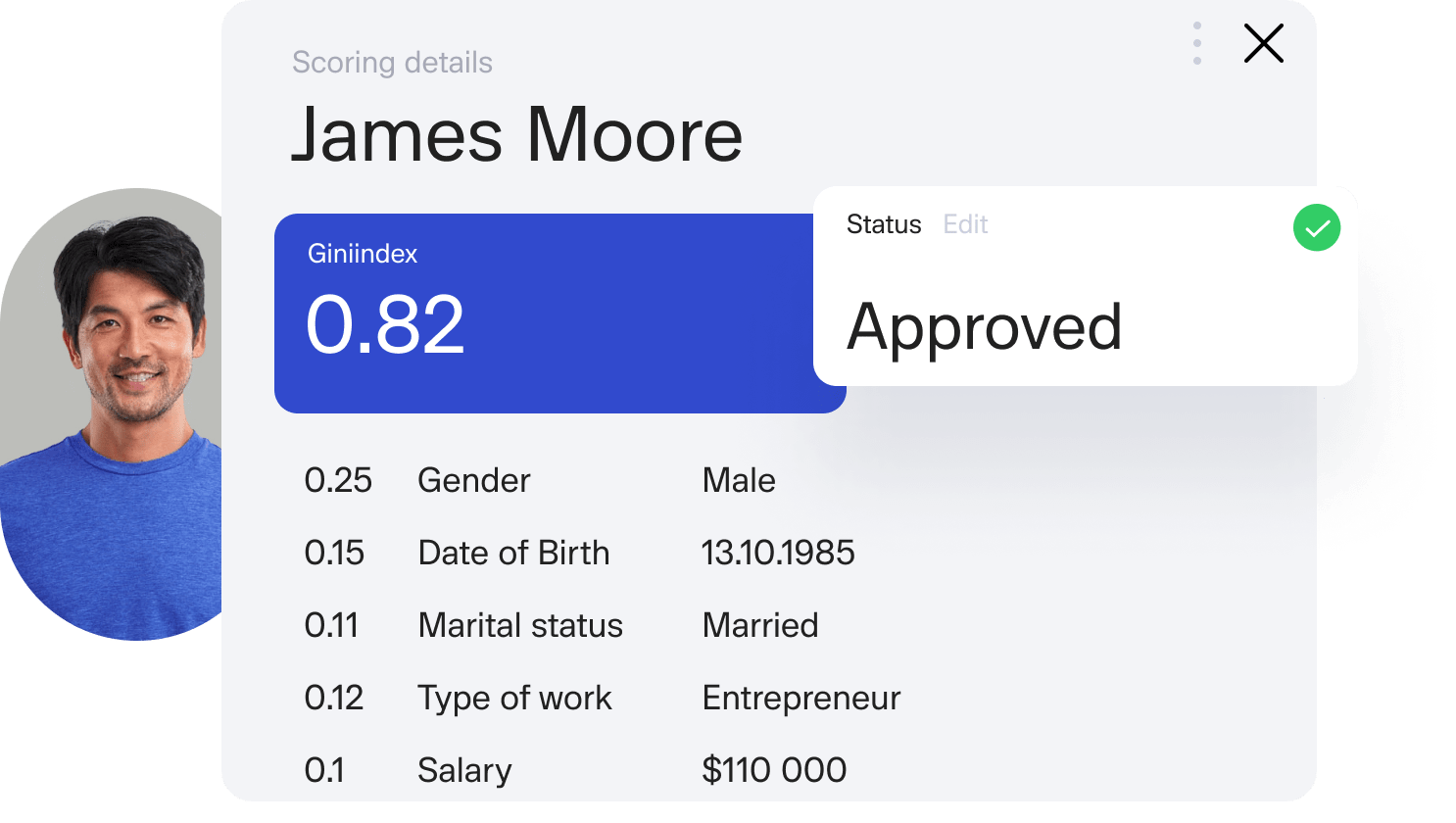

Automated application scoring in banks and fintechs saves time, increases returns, and makes it possible to process thousands of applications within minutes. Suitable for big data analysis and any business domain.

Using an automated credit risk management solution for credit scoring, lenders can grant loans at low risk and reduce non-performing loans. The software fits online lending, commercial and POS lending, auto finance, credit card lending, and more.

Spend a coffee break revealing new business opportunities powered by GiniMachine. Start a free trial to explore the platform in action.

Powerful ready-to-use web-based app with a machine learning core. We fortified the custom implementation of the tree ensemble method with handpicked heuristics and proprietary know-how. With no engineering skills, you send data to preliminary processing and analysis, and then receive a user-friendly display of results.

Meet the GiniMachine team, check out how it works, and discover the advantages for your business. Enter your contacts — and we will reach out to schedule a quick product tour.