AI Predictive

Analytics for

Alternative Lenders

expertise required

and raw data

predictions in 3-5 min

decision was made

Alternative Credit Scoring System

Easily assess loan applications with GiniMachine. Just upload

your

historical loan data, and it

will create a predictive model

based on past credit closure factors.

Next, upload your active

loan data in a CSV or XLS file, and the system will pinpoint

potential

non-performing loans

(NPLs).

AI Scoring Software for

Alternative Lending

Leverage AI alternative scoring tool to increase accuracy of credit

decisions and accelerate loan processing at every stage.

Increase loan origination by catering to thin-profile and unbanked borrowers. GiniMachine uses alternative data (like rent, utility payments, asset ownership, social media) for precise loan repayment predictions.

Boost loan origination efficiency and issue more credits faster with GiniMachine. Integrated seamlessly with your loan system, the algorithm scores incoming applications instantly.

GiniMachine creates unique models for each uploaded dataset, empowering diverse loan portfolio assessments. Our AI tool for alternative lenders allows limitless model building.

GiniMachine’s continuous model monitoring adapts to regulatory and market shifts, mitigates risks of outdated predictions, and avoids excess costs. It automates the process, alerting you promptly when updates are needed.

Automatically audit assets to pinpoint high-risk ones. Utilize these data-driven insights for proactive NPL prevention and profit maximization. Enhance decision-making and loan management with informed, optimized processes.

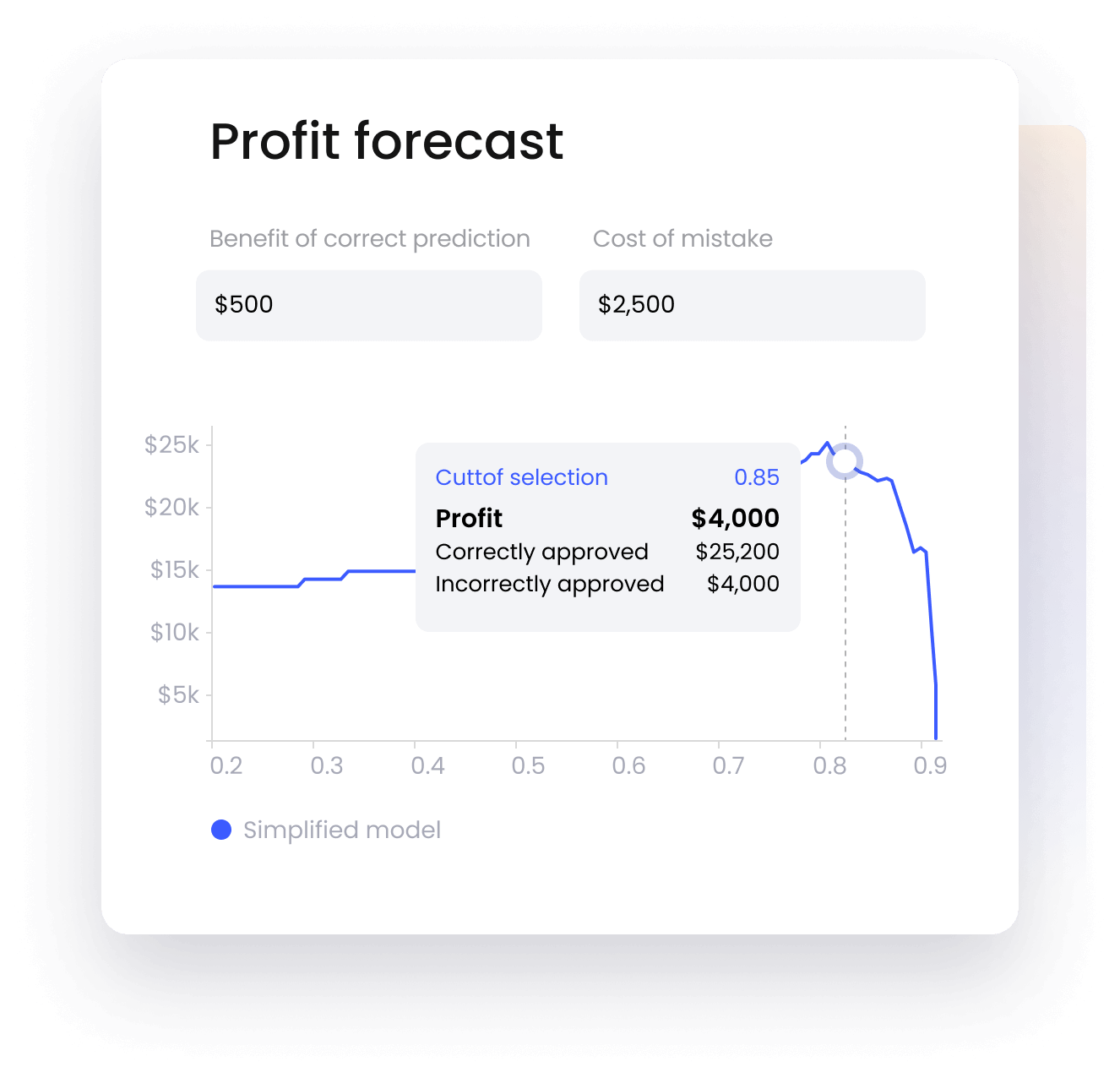

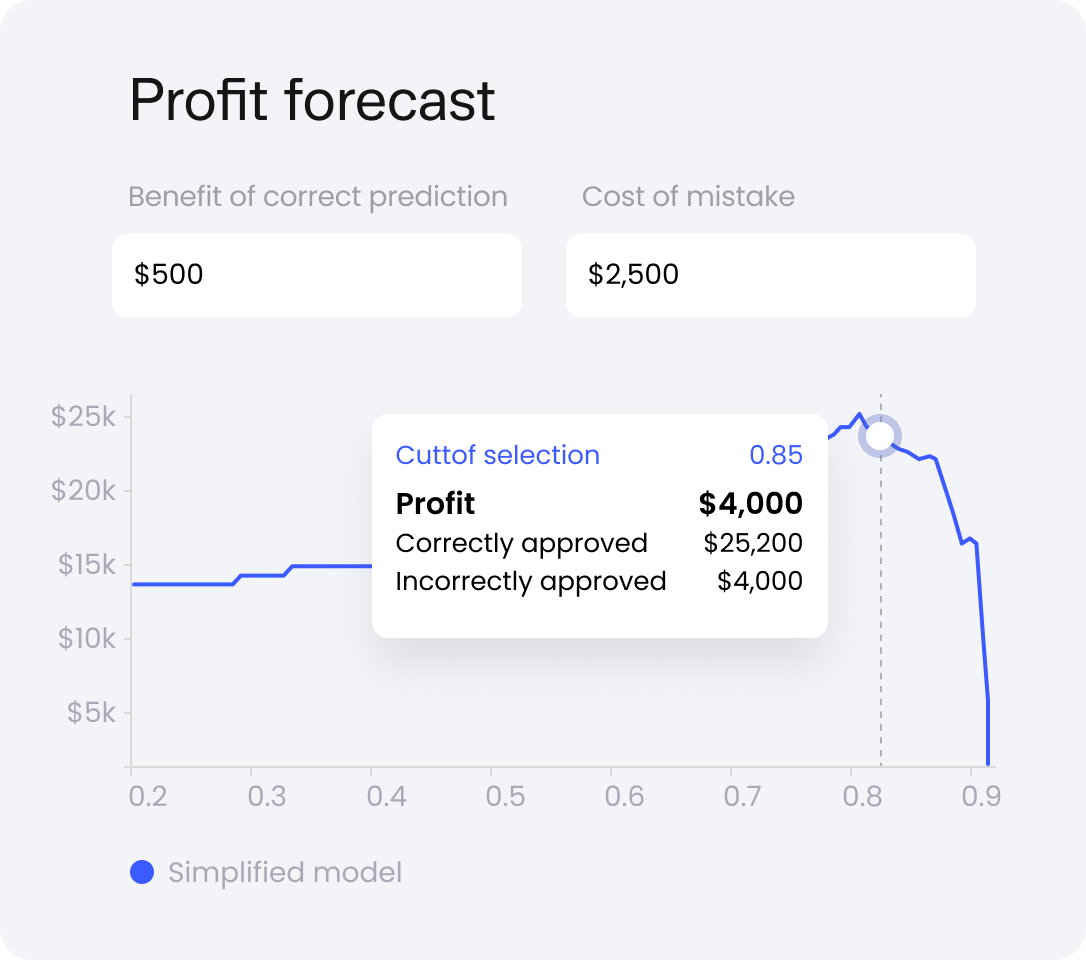

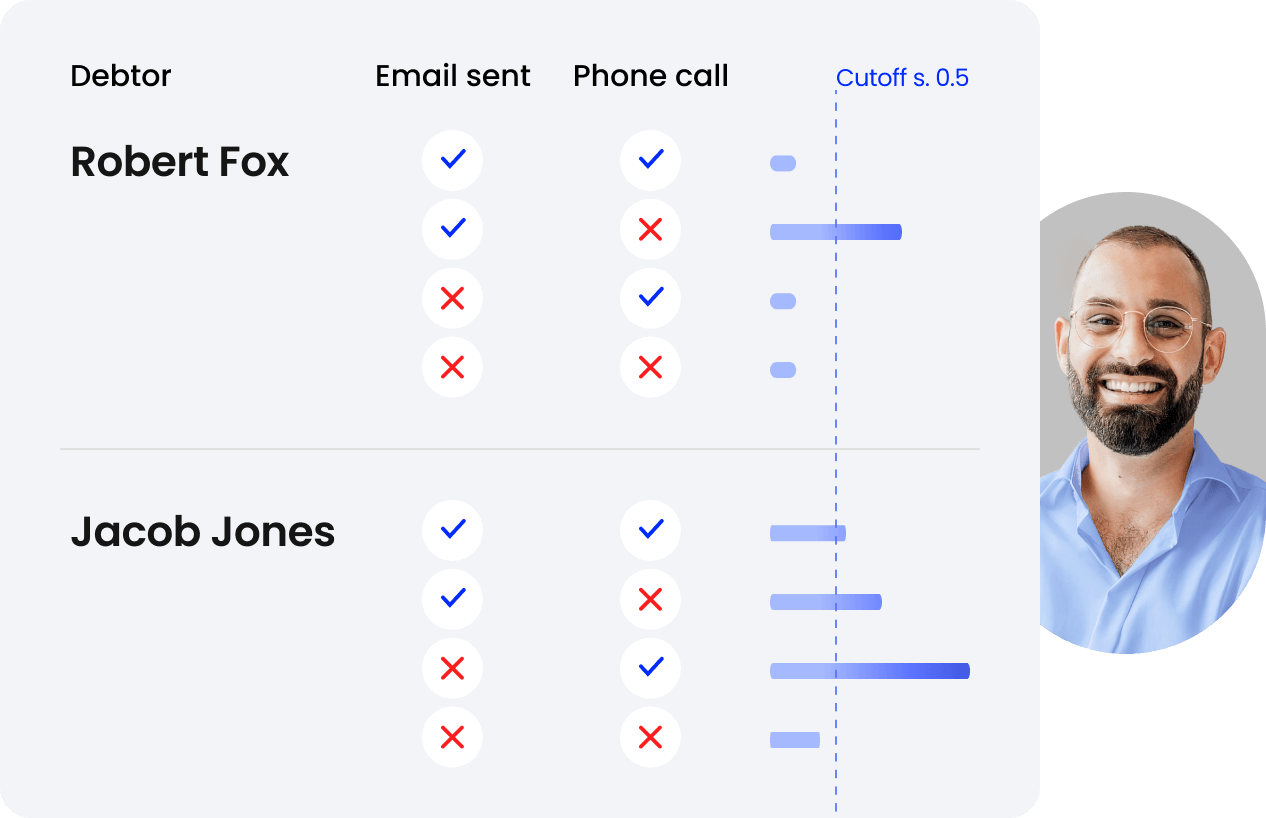

Alternative lenders enhance performance by fine-tuning the cutoff point, balancing precision and recall. This risk customization tool helps define the acceptable proportion of risky assets in the loan portfolio.

lenders with innovative scoring approach.

Complete Debt

Management Software

types of institutions.

Profit Forecast

Use GiniMachine’s profit forecast tool to evaluate your loan portfolio performance and spot potential delinquencies. It factors in all costs to calculate accurate loan approval profits and the expense of inaccurate approvals, aiding in effective portfolio profitability assessment and focus area identification.

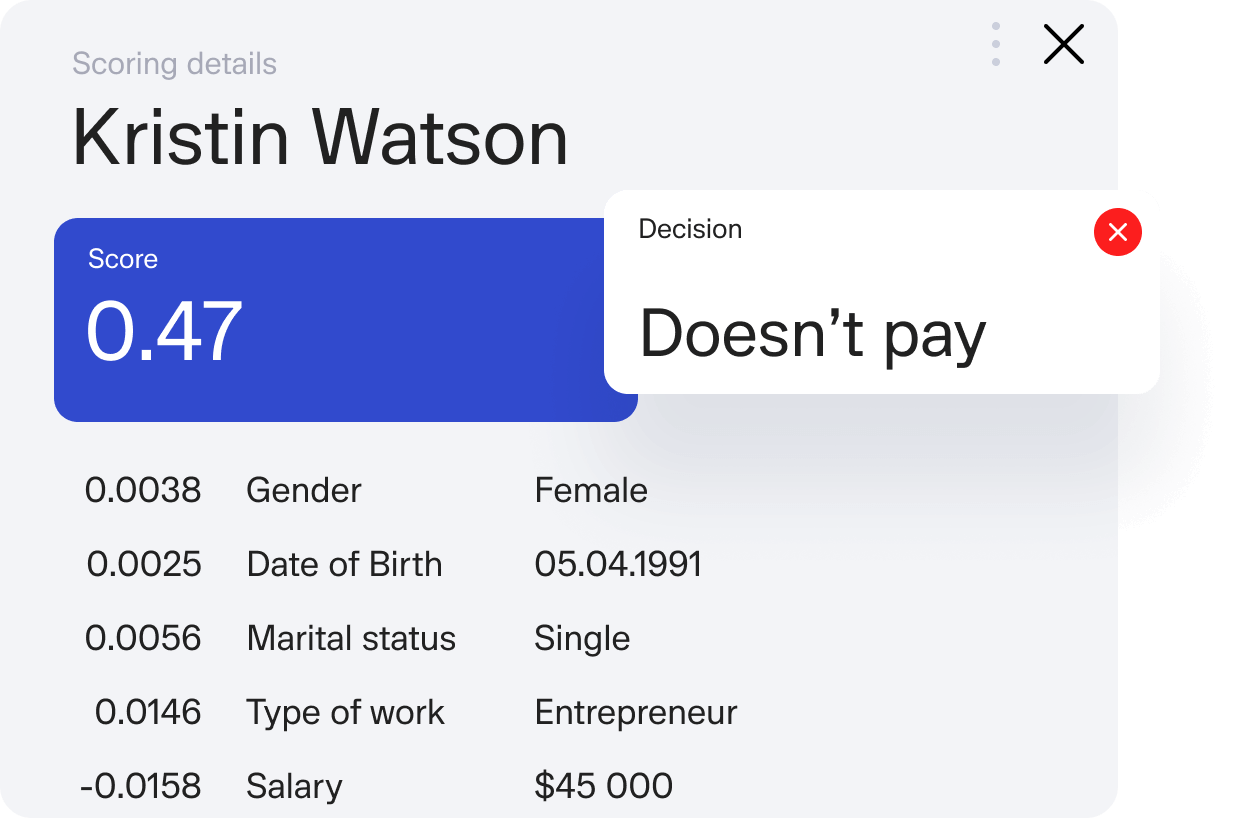

Results Interpretation

Boost transparency with GiniMachine’s explainable alternative scoring. Meet regulatory needs with auditable decisions. GiniMachine visually represents key decision influencers, allowing clear understanding. Monitor system-considered factors and export detailed reports for easy analysis.

AI Debt Collection

Automate debt collection for higher asset liquidity and fewer NPLs. See a major reduction in Days Sales Outstanding. GiniMachine suggests optimal payback methods and personalizes strategies per case. Leverage this for scalable debt portfolio segmentation and efficient debt collection.

Fast and Free Credit Department Audit

Consider Using

GiniMachine To

See how GiniMachine can facilitate overcoming

alternative

lending pitfalls and improve your

business

performance with the power of artificial

intelligence.

- Lower NPA/NLP for your business

- Keep your accounts receivable from selling

- Speed up application processing

- Measure and improve debt collection performance

- Build the debt collection department

Suits Diverse

Alternative Lending

Expedite loan processing, enhance the accuracy of credit

decisions, and eliminate defaults in

outstanding debt with AI-driven

alternative scoring software.

Commercial lenders leverage alternative data for superior risk assessment, informed decisions, and optimal interest rates. ML algorithms cut underwriting time and boost efficiency. Alternative scoring strengthens risk control and portfolio management, aiding in risk identification, repayment tracking, and loss mitigation.

Alternative credit scoring boosts customer reach, risk assessment, decision speed, and market access while reducing bias. By leveraging alternative data sources and advanced analytics, you can make more informed lending decisions and tailor their products and services to meet the diverse needs of borrowers.

Alternative scoring expands the BNPL customer base. AI refines borrower profiles for tailored loan terms. GiniMachine’s accurate creditworthiness assessments reduce bias, speed up decisions, and automate processes.