Predictive

Analytics

in Banking

AI-based Predictive Analytics for Banking Services

the banking industry. The platform learns from your previous

experience. Upload your past data to develop models and make

smart business decisions in minutes, not days.

Banking Intelligence

Elevated by AI

swift, precise, and transformative

Credit Scoring

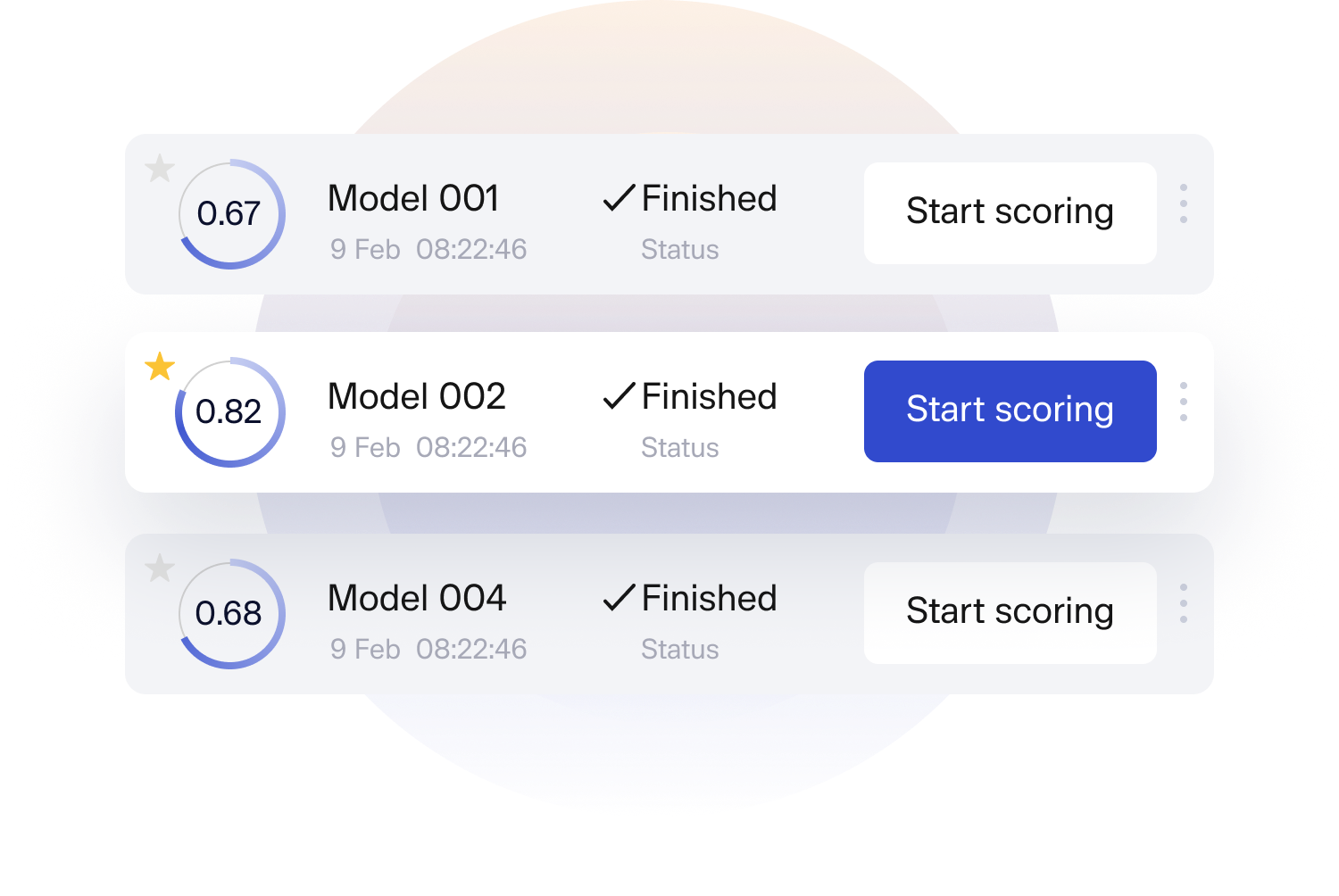

GiniMachine enhances the quality of your credit portfolio and minimized NPL. With our AI-driven platform, application assessments are expedited, eliminating tedious manual tasks and routine processes. Moreover, GiniMachine provides insights into profit forecasts and precise probabilities of default, empowering you to make informed lending decisions.

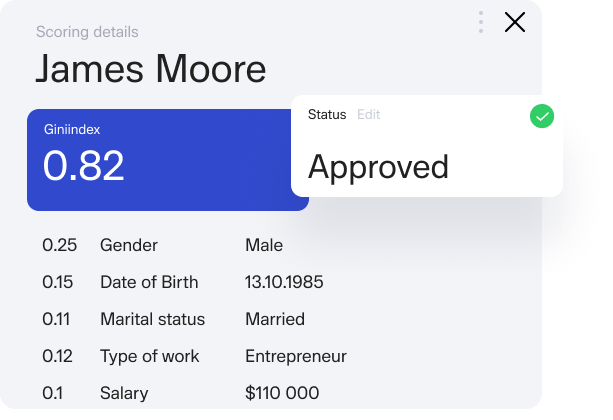

Learn moreCollection Scoring

The tool streamlines collection scoring by adeptly assessing the likelihood of debt repayment, enabling you to devise effective collection strategies. Our platform offers advanced risk simulations, guiding you in shaping a robust debt collection portfolio strategy. With GiniMachine at the helm, manual interventions are significantly reduced, ensuring a more efficient and strategic approach to debt recovery.

Learn more

ready to redefine your decision-making process?

Advanced Algorithms for

Banking Analytics

with banking expertise.

GiniMachine

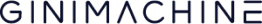

3.0 Model

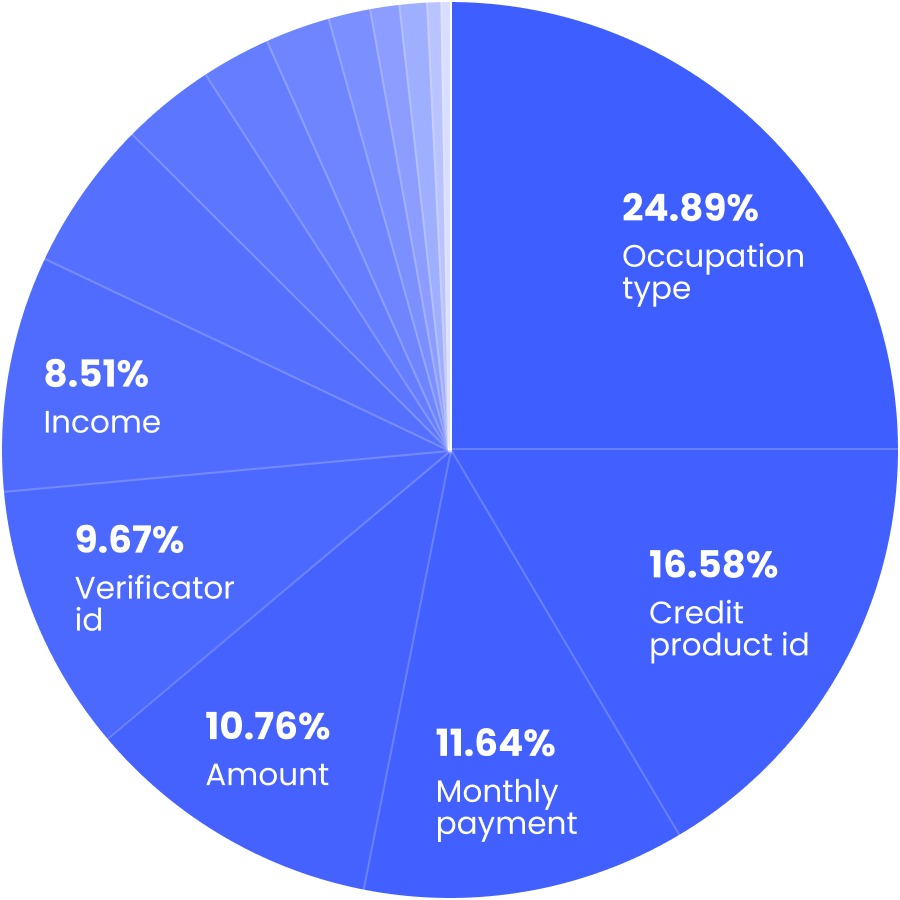

GiniMachine delivers a precision-driven predictive model specifically crafted for the banking sector’s intricate datasets. Its automation capabilities are primed for scalability, guaranteeing steadfast performance amidst extensive banking data flows. More than just forecasting, it highlights pivotal financial indicators, allowing for a profound grasp of banking data trends.

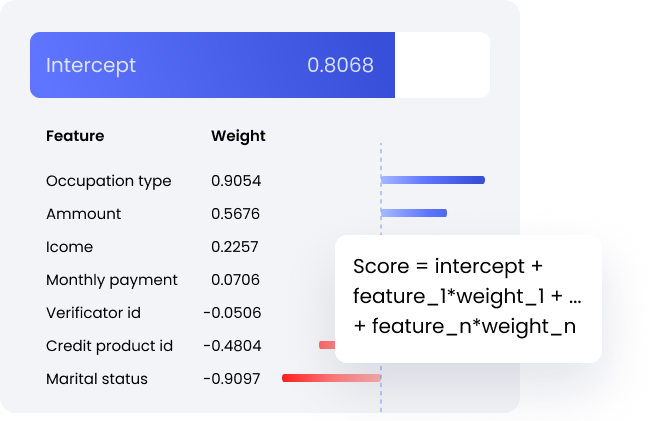

Logistic

Regression

The tool unveils a model finely attuned to the complexities of banking data. It swiftly calculates the probability of default, illuminating the core financial dynamics. The model underscores key financial indicators, offering bankers a detailed perspective on pivotal drivers. In line with banking regulations, its ‘white box’ approach guarantees utmost transparency and reliability.

Fast and Free Credit Department Audit

Where Banking

Meets Analytical

Brilliance

alternative lending pitfalls and improve your business

performance with the power of artificial intelligence.

- Reliable on-site software deployment

- Full transparency with an open white-box approach

- In-depth analytics for strategic insights

- Continuous real-time performance monitoring

- Smooth and effortless integration with APIs

Credit and Collection

Scoring with AI

to enrich both your credit scoring and collection processes