If the credit history is the only criteria that you’re using for deciding a client’s loan risk, you could be missing out on a wealth of potential clients.

In the US, 26 million Americans have no credit score. So, when it comes to loans and lending, they are invisible. On top of this, another 19 million have an insufficient credit record, meaning they cannot get a credit score. But does that mean they are unworthy of credit or unlikely to pay it back?

No. The fact is no one knows how credit-worthy these potential clients are as traditional analysis methods fail to take into account their circumstances and creditworthiness.

So then, is there a better way to be more financially inclusive while still assessing the risk of a potential client to your business? Yes, there is. And it’s called alternative data.

What is Alternative Data?

Alternative data is any data that is not your client’s credit score. It is gathered from a variety of sources and aims to inform your business about your client’s creditworthiness and the risk they pose in terms of repayment.

Alternative data draws in a wealth of information ranging from:

- Rental payments

- Utility bills

- Social media

- Employment history

- Property records

- Government payments and more

To deliver a more informed overview of who your client is as a person and lender. Armed with this data, you as a company can decide whether or not to grant a loan or turn it down.

Alternative data for lending works by illuminating the client’s financial spending and saving habits and essentially reviewing their character – one of the key five C criteria in lending.

Note. Alternative data can also be used to assess risk for business lending as well.

Are Alternative Data Better than Traditional Credit Scores?

Alternative data is a reasonably contemporary concept. This means we’ll need to wait a while until it matures to proclaim it the king of risk assessment and see if it is more effective than traditional credit scoring.

That said, even in 2019, there was evidence for alternative data. 65% of lenders were already using some form of alternative data to make loan decisions. What this indicates is that traditional credit scoring is not enough.

To help you decide if alternative data fintech is right for you, let’s look at how they measure up to the five Cs of credit risk assessment.

Character

Traditional credit scoring: Credit scores only see numbers. This means that they only take into account historical credit data. And this can be misleading. A poor credit score means that a person is poor at repaying loans or other obligations. However, an individual with little or no credit history can be affected too.

Alternative data: Taking into account a broad range of information, alternative data builds a more complex character of the individual and their level of responsibility when it comes to finances.

Capacity

Traditional credit scoring and credit assessment in banks: Existing loans may affect repayments, it’s true. But what about that Netflix subscription or a phone package. Traditional credit scoring deals directly with the historical credit data and a client’s capacity based on current credit and available funds, but this tells little of spending habits. That said, it can make a company aware of serious blockers to repayments that would make a loan riskier.

Alternative data: Deriving data from a variety of sources, alternative credit data takes into account more factors when it comes to repayments. With permission, intelligent algorithms can analyze current client obligations (aside from significant loan repayments) and give a more informed review on if the client has the capacity to repay a loan.

Capital

Traditional credit scoring: The more finances your client has available, the less likely they are to default on their loan, right? Partly true. However, purely available capital doesn’t provide the full spending picture.

Alternative credit scoring fintech: Drawing from a wider range of sources, alternative data can incorporate any other income streams that may affect the loan and account for more diverse payment information.

Collateral

Traditional credit scoring: Lending is never risk-free. That’s why providers often ask for collateral in return. Traditional credit scoring calculates collateral based on previous credit history, which might not reflect today’s circumstances.

Alternative data: Empowers lenders to consider a wider variety of factors when deciding how much collateral is needed to guarantee a loan.

Condition

Traditional credit scoring: Knowing which conditions to offer a client can be a challenge so that the loan you’re providing remains competitive but doesn’t place your business under unnecessary risk. Credit scoring helps as it gives an indicator of a client’s repayment abilities.

Alternative data: By understanding the client’s character and capacity in more depth, your company can offer a genuinely competitive loan. There is also the potential to tailor financial repayment options more acutely while not taking on unnecessary risk.

The winner? Both! By combining traditional established methods of credit risk assessment and new technologies of alternative credit data solutions you can be sure that your lending process is more effective.

What Should an Alternative Data Report Include?

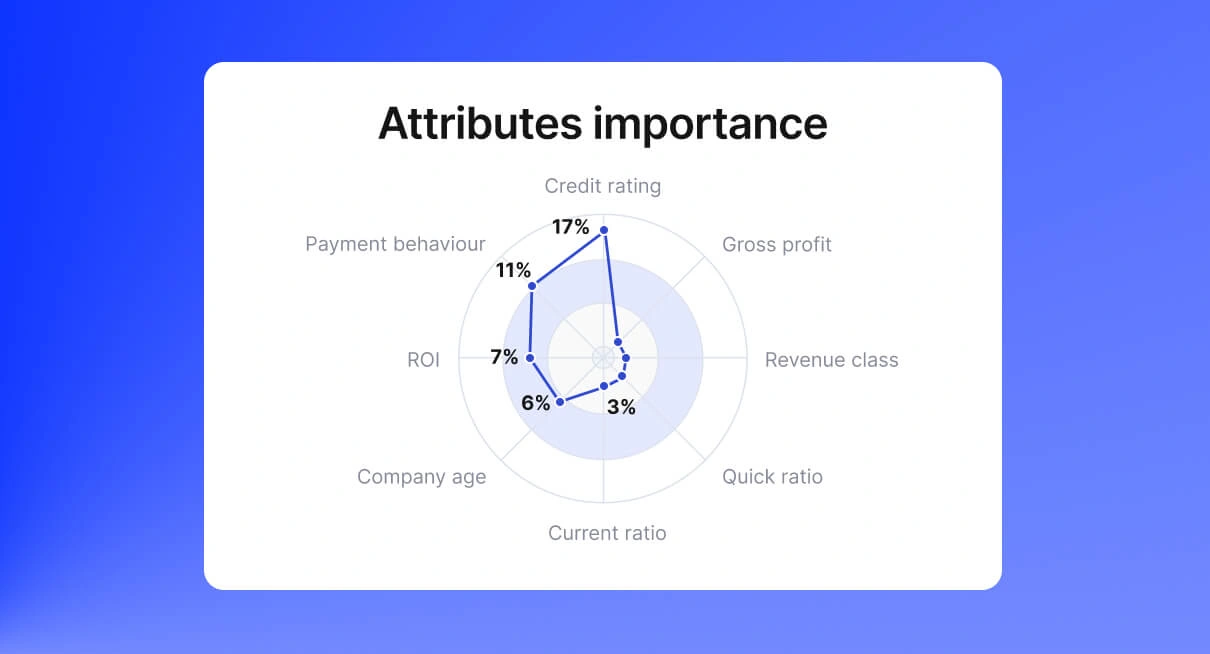

Data is king. It defines who the client is, what they do, and how likely they are to take accountability and repay a loan. Alternative data derives its sources from a variety of personal data and is used to create a report. Each report by alternative credit data providers should contain the following elements to establish the credit risk of a person:

- Coverage: This is the range the data source will include and where it is acquired from.

- Specifications: Vital personal information about a loan, credit, or other, taken over time to specific criteria.

- Accuracy: All data should be accurate and correct.

- Timely: Ensures that data is relevant to the current situation.

- Predictiveness: Data should be relevant to the requirements being assessed.

- Orthogonality: Works in tandem with traditional credit scores

- Compliance: Meets regulatory compliance standards and does not breach data protection laws.

Armed with this information, using help of a credit scoring fintech, a company can make lending decisions more efficiently, effectively, and confidently that they are making the right decision based on all the available data.

Alternative Credit Data — Where to Start?

The fight to reduce bad loans can seem like an uphill battle. But by engaging the right technology at the right time, your business reduces the risk of taking on unfavorable loans in the first place.

The power of alternative data fintech can be harnessed and integrated into your company’s software using custom or adapted software. To get started, the first thing you need to do is get in touch with a reliable service provider to discuss your options and possibilities to get started as fast as possible. It’s time to protect your business in a new, smarter way and explore the power of data today.

Want to try alternative scoring? Get in touch with the GiniMachine team.