Today’s consumer credit market stands at $4,184.4 US billion, a rise from $3,636.4 billion compared to just five years ago. With the market expanding steadily, lenders are increasingly turning to technology to improve their operations, and artificial intelligence in lending is coming into its prime.

A recent survey by the World Economic Forum stated that 85% of respondents had already implemented AI lending in some form or another. With a further 77% believing that AI will be essential in their business in just two years.

But why is AI in lending and banking making such a big wave? And how are alternative lenders adapting to the trend to become competitive with larger providers? To understand that, we first must look at the market today.

Artificial Intelligence in Lending: the Market Today

Today’s lending market is a far leap from the one we saw 10 or even 5 years ago. Since the 2008 financial crisis, lenders have been increasingly vigilant about the loans and services they provide, both due to increased regulation and the genuine need to deliver sustainable services. While, overall, this has been a stabilizing force that delivers market security. The increased stringency has meant increased costs, paperwork, and vigilance, which are somewhat at odds with the rapidly moving financial market.

Factors ruling the lending marketing today

In a fast-changing environment, it’s vital to understand the drive behind the changes. Here are some of the factors affecting today’s lending market:

Coronavirus

Ever since the coronavirus crisis hit in early 2020, it has and remains a defining market factor. Alongside the drive to remote working, COVID-19 changed how we do business, perhaps forever — 60% of banks cut opening hours but introduced new digital features. In the lending market, like many other industries, it accelerated digital change exponentially. Additionally, there is a need for businesses to be prepared to quickly adapt to changing situations at a rapid pace, and this is something that proved difficult for traditional financial structures.

Changing consumer behavior

We are living in a new era of finance, an age of transition from brick and mortar to digital. But it’s not just where we do finance that’s changing. It’s how. Modern lenders, primarily from the so-called Gen Z and Millennial generations, are increasingly gaining financial power, and they demand more flexible, relevant financial services, and that includes lending.

To keep up with market demand, even traditional providers have to re-evaluate if the products they provide are relevant to the market and to do so. They engage smart technology such as AI.

Smarter lending

Subscription services are growing with the likes of Amazon, Netflix, etc., taking the lead, but it’s not just entertainment that’s behind the drive. Instead, subscription culture is a future trend in almost all industries. And it could be changing the way we do loans too. When Gen Z and Millennials are more likely to rent than buy, in the future, we may see changes to one of the major lending industries—housing. In addition, these generations are more likely to see value in business, sustainability, and other services, meaning the way people lend is changing.

The unbanked

In the world today, around 1.7 billion people remain unbanked, and that’s not to mention the billions who are underbanked—not receiving the banking services they require. Lack of financial inclusion isn’t just a question of poverty. It’s a question of a country’s economic health and potential for growth. When people remain unbanked, they fail to access the economy and participate in it, and this is not good for business. By being able to deliver services, such as loans, to the unbanked and underbanked safely using alternative methods to calculating credit scores, businesses open themselves to increased potential.

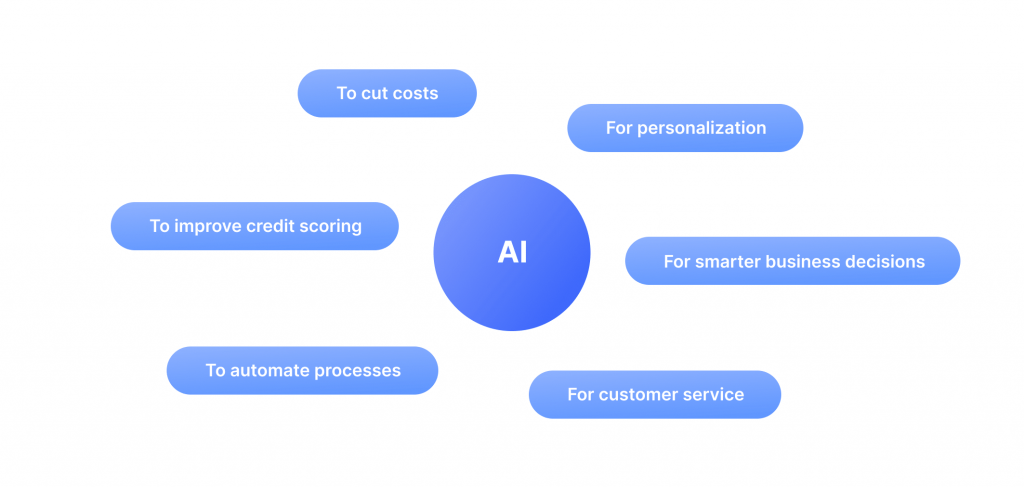

What AI Lending Solutions are out there?

With the knowledge of some of these market-defining factors in mind, now’s the time to question which solutions are best suited to the job and where changes can be made.

AI to cut costs

Speed, accuracy, operational costs are all areas that financial firms can benefit from when employing AI banking technology, but it’s not just efficiency at stake. These factors also influence the cost. Today 37% of financial companies state that AI has helped them save, and this is a promising start to the future. By saving in certain areas, firms can focus on other areas, such as customer service, and improve the quality of their business offering. However, at this moment, business owners equally state that the cost of implementing AI in lending is a blocker in advancement (89%).

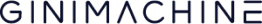

AI to improve credit scoring

Current credit scoring systems rely on data from a limited number of providers. In the US, there are just 3 accredited national bureaus. While this knowledge is helpful, by and large, the systems used to analyze creditworthiness are outdated. They fail to take account of the full range of factors that affect risk. By using AI, lenders can analyze a broader range of information and potentially increase the number of people they can lend to safely.

AI to automate processes

From onboarding to form filling to risk checking, administrative processes in the financial world are time-consuming. This is why many companies are increasing onboarding AI automation to help—according to a recent survey. This could be as many as 66%. By saving time on repetitive processes, companies can focus their staffing energy on other areas.

AI for personalization

Personalization in business is no longer optional. Instead, personalization is new market demand. Clients expect a business to specifically cater to their needs, not those of a ‘target market,’ and that’s where AI comes in. With the potential to analyze Big Data, AI is the power to help businesses tailor their services to their clients while lowering the risk of lending.

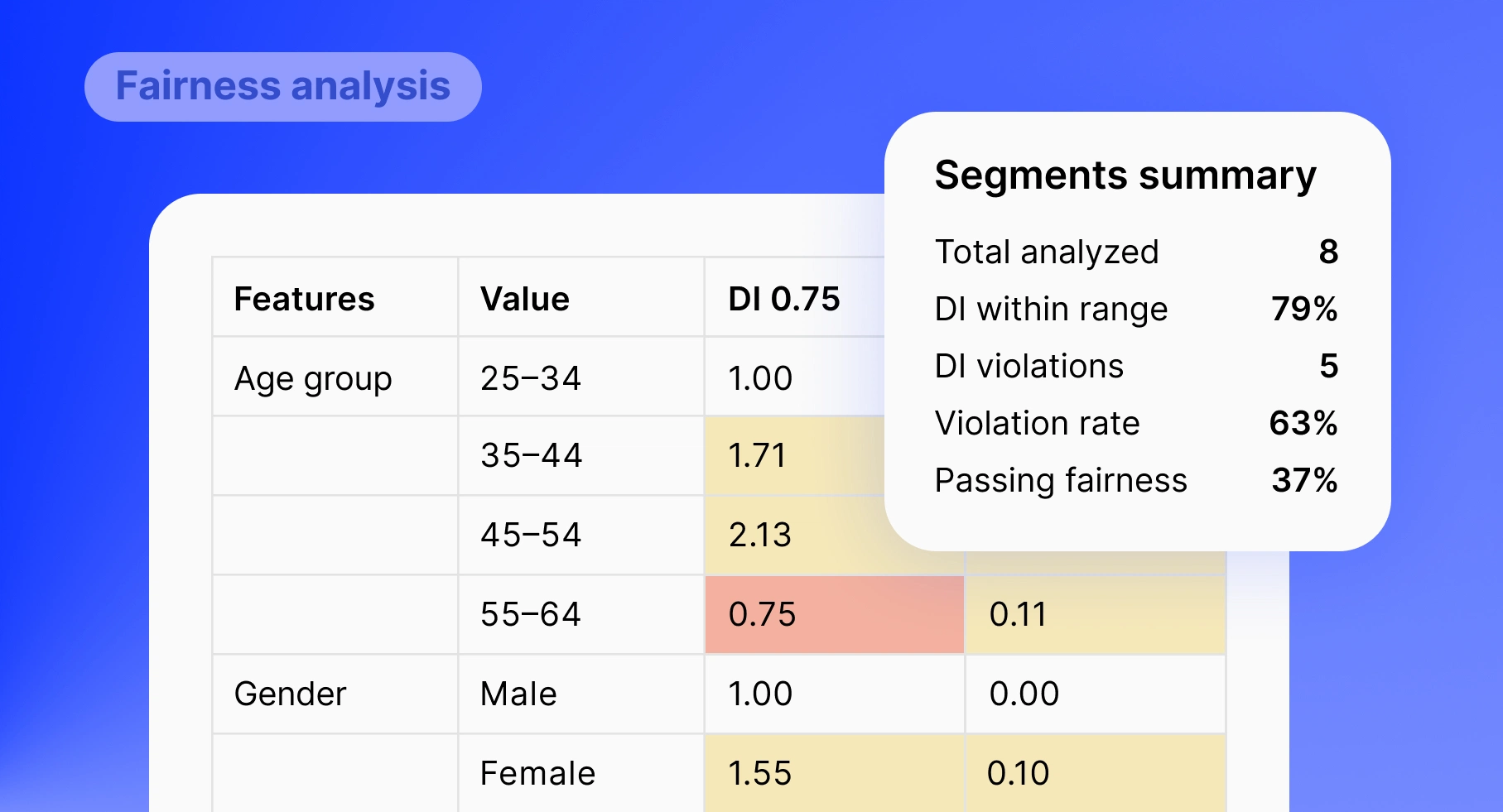

AI for smarter business decisions

Taking personalization to a larger scale, Big Data and AI can deliver vital insights to the company as to their actual and not assumed market. This helps financial organizations make smarter decisions overall and not rely on outdated data or stereotypes.

AI for customer service

But AI isn’t just about endless reams of data or paperwork. It can be customer-facing too. Smart chatbots and customer service software can help customers get answers to the most asked questions without wasting time. Overall, this boosts customer satisfaction and trust in the business.

Comparing Alternative Lenders and Traditional Providers

With 50% of traditional providers stating that they believe financial tech companies to be a threat in the future, it’s time to explore just how the two measure up. What can traditional providers learn from their modern counterparts and vice versa?

Market access

Traditional lenders could be missing out on profitable areas of the market due to an over-focus on ‘safe’ and profitable lending. Larger traditional providers often prefer to lend to established businesses and individuals with a solid credit history. While this strategy has been profitable so far and may appear effective, it is leaving other industry areas underserviced, specifically private lenders with a poor or non-existent credit history and SMEs, and that’s not to mention that the number of such large firms is limited.

Conversely, alternative lenders can utilize technology to safely access are service these market areas by providing loans tailored to need. To put this into perspective, in 2018, approved loan applications looked this:

- 58% by big banks

- 71% by smaller banks

- 82% by alternative online providers

What the data tells us is that alternative providers are more willing to lend than their traditional counterparts. But isn’t this risky?

In its essence, all financial transactions involve an element of risk. By using AI in banking, businesses can safely assess the risk of lending and provide competitive terms to underserved borrowers.

Flexibility

Alternative lenders are often faster to adapt to market trends. Statistics show that in terms of digital services, non-traditional providers are always faster to adapt in almost all areas — virtual debit cards 26% vs 2%, chatbots for use cases 15% vs 4%, chatbots for transactions 12% vs 2%, etc. When it comes to lending, traditional financial providers are often limited by the plans they have available. In today’s market, this is just not competitive enough.

Next-generation clients are digital natives who constantly seek out the best rates and services, and alternative lenders are ready to step up to the plate. By offering fast approvals on more personalized-style loans, alternative lenders fill the market gap seamlessly. In addition, they also allow new borrowers to build a credit history and access a wider range of services in the market.

Sustainability

One concern that has continued to plague the lending industry is the fear of another subprime mortgage scenario, making traditional lenders more cautious when providing financing, and rightly so. However, failure to take account of market changes, including technological advancements, could prove equally fatal.

Rates

With greater risk comes even greater responsibility. For some online lenders, the freedom to lend to a wider range of people and businesses more quickly and flexibly comes with a cost. High APR (annual percentage rates) may be used to offset any risk incurred by alternative credit checks. This can leave lenders paying more than they should. In this respect, traditional lenders can deliver lower APR but with more stringent credit checks, giving them somewhat of an advantage. However, with the right technology on board, both traditional and alternative lenders can safely expand their offerings while keeping risk as low as possible. Artificial intelligence in banking can be used to collect, analyze, and utilize data to define risk, and set appropriate rates for real clients, not statistics.

Lessons for the Future

Digital is the future, at least. That’s what the data says. Organizations, whether fintech or traditional, that are quick to adopt modern technology do better than those that don’t. According to a survey by Deloitte, “Digital champions don’t only lead their peers in the number of digital functionalities along the customer journey, those that are incumbents outperform other incumbents in their country on average on both C/I (-4.0 p.p.) and ROE (+1.9 p.p.).”

What this shows us is that no matter whether you’re from a traditional financial background and looking to update your technology stack or from a cutting-edge fintech, onboarding the right technology that benefits your clients is key.

Want to try artificial intelligence lending? Get in touch with the GiniMachine team to alternate lending.