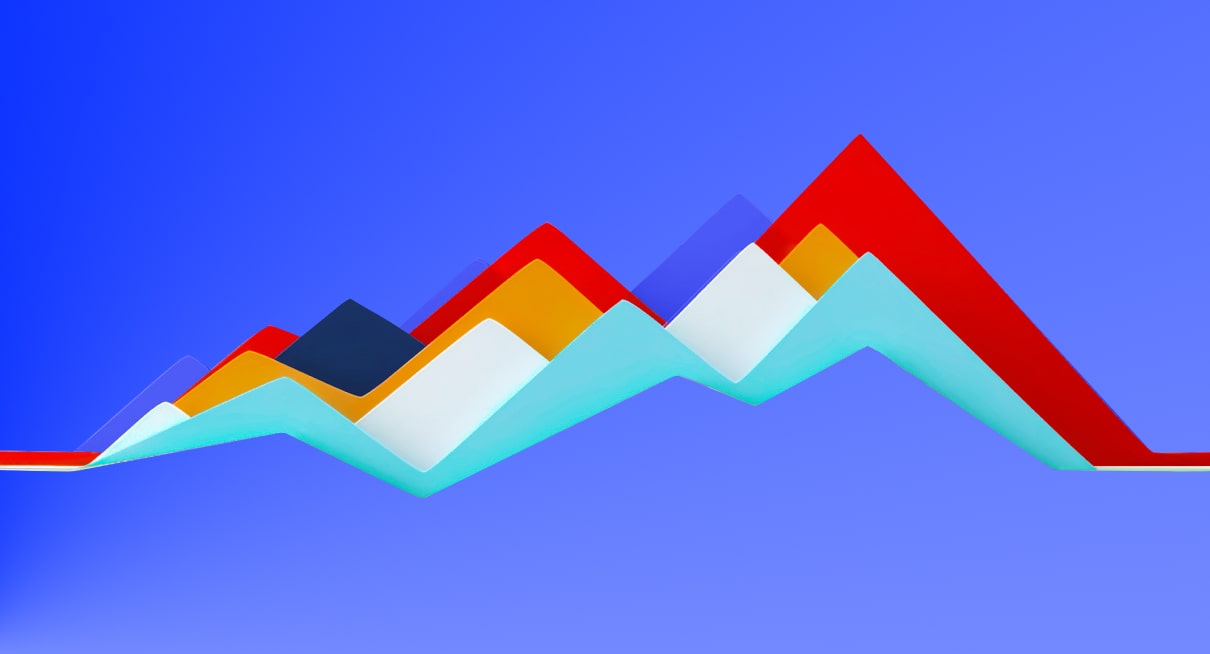

Everyone’s talking about how the COVID-19 pandemic dramatically shifted our consumption of products and services, sparking digitalization across nearly all aspects of life. But in reality, this digital shift began well before the pandemic. The need for inclusive and integrated financing was already there. What COVID-19 did was fast-track the modernization of banking processes. It nudged many banking and non-banking firms to embrace positive changes in customer satisfaction, financial product marketing, and innovation. Put simply, it sped up the move towards more digital and personalized financial and banking services.

In an era of abundant consumer choices, financial institutions must not only focus on personalization but also understand how scaling personalization can transform their entire business model. Financial services can take cues from other industries, like streaming services, which have adeptly adapted to consumer preferences.

An extract from the PWC report: “Digital intelligence: Choose-your-own-adventure model in financial services.”

Customers, be they individuals or SMEs, aren’t swayed by banking services advertised on billboards. Every client expects a commercial offer that’s tailored to their unique needs. Fortunately, financial businesses often possess vast amounts of data that can aid in crafting personalized products. However, this data often goes unused, leading companies to miss out on potential thousands of dollars.

Whether your business is gleaning insights from website cookies, conducting client surveys, or diving deep into customer preferences based on their credit product choices, it’s vital that these insights are anchored in comprehensive client data. Relationship banking is poised to become the linchpin for both bank and non-bank lenders in the forthcoming decades.

Today, the data you gather on client behavior isn’t merely information—it’s a veritable goldmine. It holds the key to transforming your services into lucrative ventures. Indeed, in the contemporary business world, data is the new gold!

Problem Solving with AI. Credit Company Example

An APAC-based credit company, with a clientele of over 300,000 individual borrowers, confronted a daunting challenge. They witnessed a 10% surge in the default rate on loans within a single operational year. This uptick threatened potential losses amounting to approximately a hundred thousand dollars.

Solution with GiniMachine

GiniMachine, through its feature set known as GCredit, intervened to transform these looming losses into actionable insights, ultimately aiding in the reduction of business expenses. Here’s the step-by-step approach:

1. Data Analysis:The platform meticulously examined the bank’s historical data.

2. Segmentation: Borrowers were categorized based on their employment sector. This segmentation unearthed correlations between specific employment sectors and their repayment capabilities.

3. Integration of Macro Indicators: The system was enriched with additional macroeconomic indicators. These included employment levels, sector-wise unemployment rates, GDP, inflation rates, and average borrower salaries by employment type, among others.

Key Insights

Our analysis revealed that borrowers associated with the trade and transport sectors were particularly prone to defaults. A deeper dive indicated that internal crises within these sectors, such as delayed salaries or workforce downsizing, compromised borrowers’ capacity to honor their loan commitments punctually. This led to an extension in the average loan repayment duration by 10-15 days for these borrowers, pushing some credit contracts into default or delinquent payment status.

Outcome and Benefits

With GiniMachine’s AI-driven decision-making mechanism in place, lenders are now equipped to discern the financial capabilities of each borrower with precision. This allows them to propose counter-offers, such as loan amount reductions or term shortening, to alleviate risks. As a result, lenders can ambitiously expand their credit portfolio while simultaneously curtailing credit risks via segment-based lending. The seamless integration of GCredit with the lender’s LOS/LMS ensures that the borrower evaluation speed remains uncompromised, even with a burgeoning assessment pipeline.

Conclusion

Data-driven decision-making isn’t just a futuristic concept—it’s an essential practice. Relying on traditional analytics methods can limit your potential and hinder progress.

We at GiniMachine recognize the challenges of adopting new technologies. To ease this transition, we’re offering a free trial. This gives financial businesses the opportunity to explore GiniMachine’s cutting-edge analytics and decision-making capabilities. During your trial, you’ll enjoy unrestricted access to all our features, enabling you to witness the transformative impact GiniMachine can have on your operations.