Is Data-Driven Decision-Making the Way Forward in Banking and Lending?

‘High-level decision-making directly impacts a company’s success,’ is a statement that most people would probably agree with. Most would also probably agree that it should be informed decision-making, as opposed to a hunch or feeling. However, making informed decisions isn’t such a straightforward process, nor should we discount intuition just yet.

In 2017, research was published showing that ~50% of people base their decision-making on a ‘gut feeling.’ And although planning business decisions purely on feeling would be a poor choice, confirming or disproving theories using data-driven decision-making is a smart move.

From Gut Feeling to Informed Decision-Making: Data-Driven Decisions Journey

According to research by PwC, senior executives that strategically utilize data to make informed decisions are 3 times more likely to observe significant improvements in their companies. By combining smart business acumen and a robust data-driven decision-making process, your organization can seek to deliver significant results. But what is data-driven decision-making?

Data-driven decision-making, or DDDM for short, is an organizational process that businesses use to inform or validate business decisions or strategies. Companies that have well-established data-driven decision-making processes are known as ‘data mature’ and can easily draw on available data to make strategic decisions about their businesses.

What does data-informed decision-making look like?

For businesses that engage in data-based decision-making, the process normally starts not with sifting through piles of available data but, instead, by seeking to answer questions for the business.

The rule ‘start big go small’ works here. Begin with the big questions or problems, for example, “what do my clients need?”, “what upgrades are next on the list?” or “why do my clients prefer this other provider for this service?” and then go more in-depth. This may be, “who are my current clients and what other services do they use?”, “which technologies are other businesses using?” and “which software will improve X business process?”

In all these cases, it’s important to have a defined problem—for example, X% of clients are leaving for competitors—to work with. From there, you can define the strategic aims of data-driven decision-making and begin to highlight which types of data may be required.

Where to gather data?

Collecting data can be done in a variety of ways, depending on your organizational needs, one or more of these may apply to you. These can include:

- User testing results—data on how clients interact with a product or service: pain points, bottlenecks, bugs, etc.

- Demographic results—who are your clients, location, service needs, etc. to identify potential opportunities or future issues for your business.

- Survey responses—learn more about your clients, their likes and dislikes, and opinions about products or services.

- Available data—stored data from previous customer usage of your product or service (within local regulations)

These methods are not extensive, and your organization may draw from other sources when defining a data-driven decision-making strategy.

How do I include data in informed decision-making processes?

With all that data on hand, it can be difficult to know how to use it effectively to get results and avoid drowning in the data lake. By 2025, it’s expected that 463 exabytes of data will be generated every day globally, up from 2.5 quintillion bytes in 2018, meaning organizations don’t have a problem with available data—they often just don’t know what to do with it.

Enter technology.

Advances in artificial intelligence (AI), machine learning (ML), and big data have made it possible for organizations to take control of the data they have access to and use it to answer big business questions. It should be noted that no system is perfect and evolutions in these technologies (and others) are constantly improving. So, what does a technology-led strategy involve:

- Data cleaning—raw or unstructured data can be misleading, before data is used, it needs to undergo a cleaning process to extrapolate the valuable data and sift it from the chaff. Studies show that 80% of analysts’ time is spent in data discovery and preparation when these tasks could be automated.

- Data storage—developing a data warehouse/data lake for your data, in addition to the usage of cloud technology.

- Analytics—ML and AI tools that allow you to utilize data to answer questions

- Security—regulations demand that organizations manage their customers’ data with the utmost care. This is also known as good data governance.

- Access—not every team member needs to access data. Studies suggest that 70% of employees have access to data they don’t need. Instead, a more effective approach is to implement a data policy within an organization.

Examples of Data-Driven Decision-Making in Action

When companies implement data-driven decision-making strategies they can draw upon a number of benefits (see below), here are some of the most successful, well-known decisions made using data.

With data in its DNA, Google is a company that organizes and utilizes data to make it easier for people to find the information that they need when they need it. But how does the company utilize data internally? Its HR team has one of the premier data-driven people decisions solutions.

Let’s look at the “Do managers matter?” case (aka Project Oxygen) that was used to identify 10 key behaviors of great managers. Utilizing past experience (even scraping all manager roles at one point) and an employee survey, the company defined the characteristics of a great manager. Utilizing these criteria in hiring and with manager feedback surveys, they noticed results in turnover, satisfaction, and performance across the company.

Amazon

Like Google, Amazon is highly data-driven. Its well-known algorithm utilizes shopper behavior to make suggestions on what users may like to purchase next. By drawing upon past behavior and interests of shoppers and combining that with shoppers of a similar profile to the company has, the company makes suggestions. This is also known as the user-product, product-product, and user-user approach. According to one study by McKinsey, this algorithm, based on data, has been a factor in 35% of all sales on the platform.

Revolut

A relative newcomer to the market, Revolut is a digital bank aiming to change how finance is done. Data-driven, the company is said to run 800 dashboards and 100K+ SQL queries, meaning a huge amount of data. Data from the company is utilized internally to improve processes, inside the banking app to improve features based on user needs, and in the company’s marketing to ensure correct targeting and effectiveness.

Word of caution—do not use data in a vacuum

On the flip side, sometimes organizations place too much trust in data. In 2022, following the coronavirus crisis and market downturn, many tech companies faced layoffs due to a number of factors, including over-enthusiastic hiring strategies as a result of overly-positive market sentiment for the tech industry. This is a key example of why data-driven decision-making is part of a strategy that utilizes factors such as experience, knowledge, and intuition and isn’t a standalone solution.

Benefits of Data-Driven Decision-Making in the Banking Industry

Although it may seem obvious that data-driven decision-making is a key component in the banking industry due to the large amount of data that they process, what is the true benefit of implementing a defined data-driven decisions strategy?

- Decisions become more informed—all decisions require approval and intuition isn’t going to cut it at this point, nor should it. Instead, having a well-evolved data approach can utilize available resources to inform decisions and deliver confidence when choosing one strategy over another.

- Decision-makers become more proactive—is your business a leader or follower? Keeping ahead in the banking industry means knowing the latest trends and strategies before they go mainstream and priming your business for consumer needs. By implementing data-first strategies, you can become more proactive in your decision-making and draw from the latest data around.

- Organization becomes more efficient—every company has its pain points and bottlenecks, but it’s only by identifying them and reducing their impact can a company improve. For example, a supply chain issue could be resolved by highlighting where blockages are occurring and reducing them.

- Costs can be cut—cost savings are a major part of any organization and ensuring the lowest margins possible is key. Armed with the right decision-making tools, organizations can cut expenses and optimize spending to make it more effective overall.

- Advancing technology—as data-driven decision-making technology continues to advance, decision-making will be made easier and more accurate for organizations. For example, the introduction of natural language processing and cognitive computer science are predicted to have a significant impact on the field allowing companies to upgrade their solutions even further.

Ready to Get Your Organization to Its Ideal Data Maturity Level?

Reaching data maturity is an admirable step for any business, but it isn’t a one-step activity. Instead, it’s a process wherein an organization actively chooses to adopt a data-driven decision-making strategy and implement processes and technologies to make it a reality.

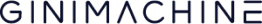

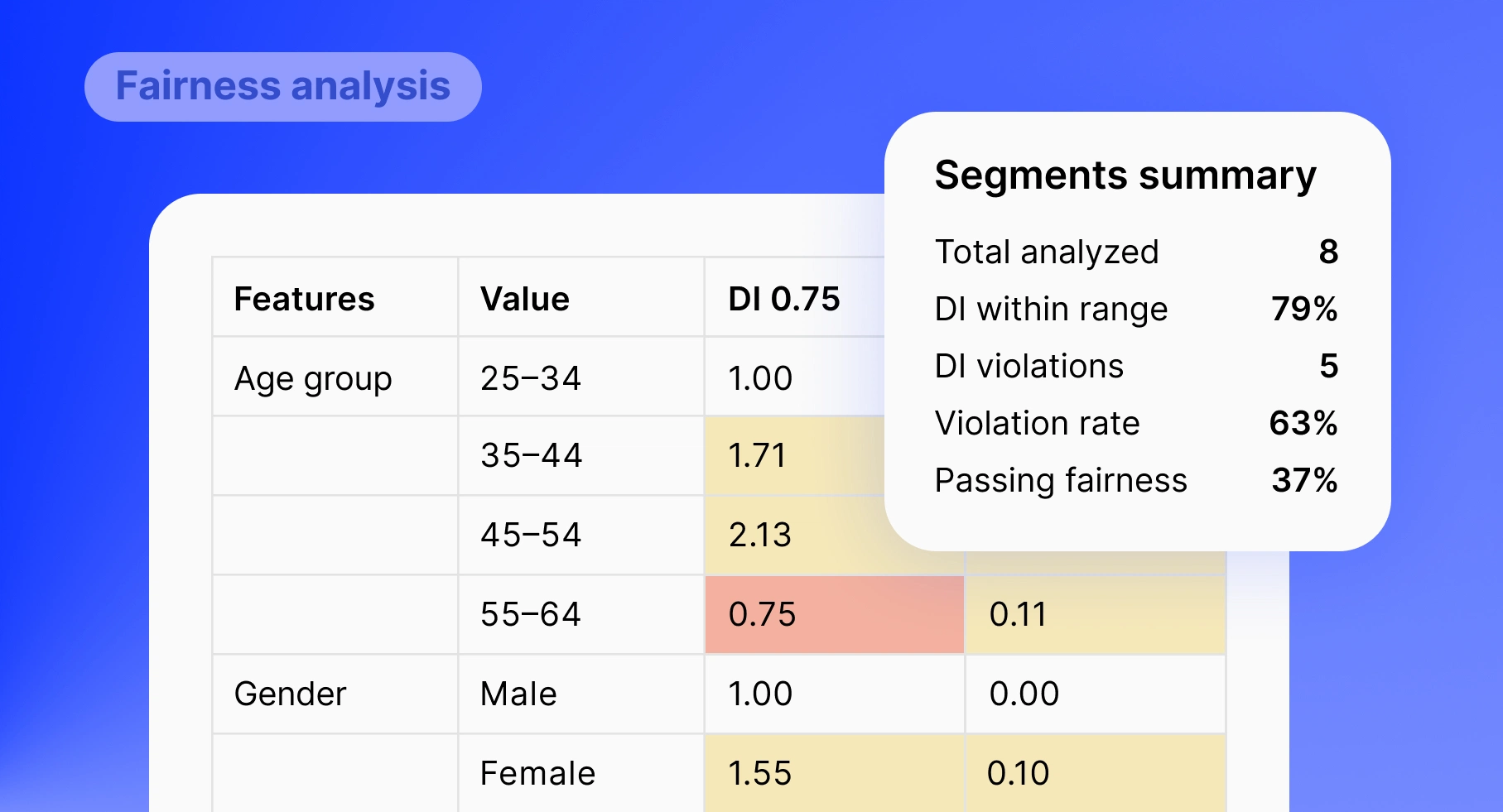

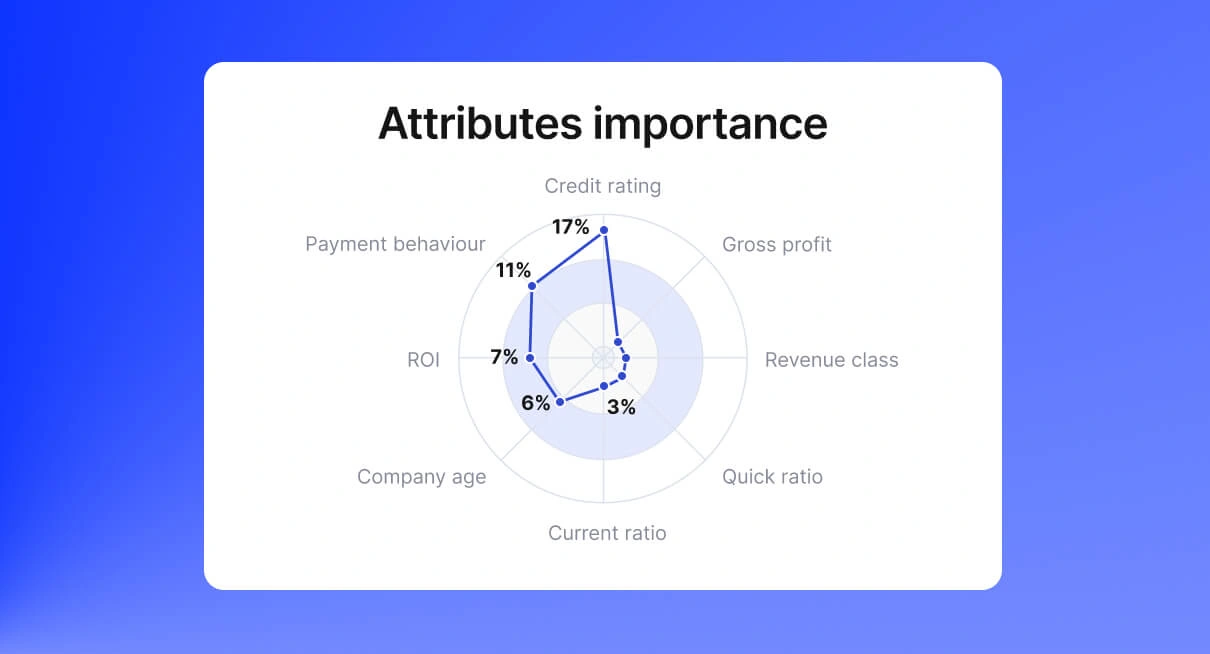

When it comes to decision-making in the banking industry, it’s essential to choose industry-specific technology that is tailored to financially-related decision-making as often this is best equipped to deal with the specifics and challenges of financial organizations. For example, GiniMachine is a solution that allows businesses to make predictions based on data that can further inform decision-making on a whole new level.

If your organization is ready to take that first step into better data usage, the best time to start your journey is now. Reaching out to our specialists can set you on the right path for success in the long term.