SMEs make up the majority of the world’s economy. So, it’s little surprise to hear that they also represent a significant proportion of borrowers as they strive to grow their businesses and ensure their future success. For lending providers, this signals some unique challenges—such as business credit scoring—when it comes to how to accurately access loan value and inherent risk while making profitable deals for all parties.

Although the mechanics of creditworthiness for SMEs may be quite similar to that of retail borrowers, there are additional factors that loan providers need to take into account to ensure that they have the right tools on hand to adequately assess and approve (or decline) loans. Let’s take a closer look.

Why is business credit scoring important?

Over 99% of businesses in the US today are classified as SMEs. They account for almost half of all employed people and 45% of GDP, meaning that small businesses are vital to the economy. The UK market paints a similar picture, with SMEs accounting for 99.9% of businesses, employing 61% of all workers, and making a turnover of 52% of the GDP.

Undoubtedly, these SMEs comprise a vital part of the world’s economy, and to continue to succeed, they need access to funding for growth, development, or sustainability. For lending providers, this presents unique challenges in how to efficiently work with small- and medium-business borrowers, while ensuring minimal risk to their business but ensuring maximum returns from this essential category of borrowers.

To do this, some lenders choose to deal solely with SMEs, while others focus on a mix of retail and business lending. No matter which way your business is orientated, it’s vital to know, which factors to take into account. For example, when dealing with SME loans, it’s essential to consider:

- Past company debt

- Previous credit repayments

- Legal problems—actual or future

- Custom base and its risk level

- Industry, its potential, and risks

- The general financial health of the organization

But how? Of course, most lenders have thrown away ‘the books’ and replaced them with a complex of modern tools that automate the calculations behind the lending process. So, when it comes down to the business of ensuring lower risks and loan repayment prediction, companies often include commercial credit scoring models, among other tools.

What corporate credit scoring models and tools are available?

Now, there are numerous systems and technologies that can help lenders. However, they have some common features and benefits, including:

- Automating routine tasks and processes

- Lowering the costs behind lending

- Speeding up the lending process

- Managing loan-related data

- Optimizing client support

- Reducing the risk with more accurate results

- Among others

All of these work to ensure that the lending process is as accurate as possible and lowers the risk for both borrowers and lenders. But when it comes to implementing business credit scoring models for SMEs—how does this work? Normally, commercial loan credit score falls under three types of implementations:

1. Classic credit checking tools

Credit scoring has changed very little since the process was digitized in the late 1980s, with organizations like FICO taking the lead. This is still an entirely valid method of checking credit scores today and many lenders evaluating medium and small business credit risk choose to undertake tried and tested methods delivered by credit bureaus and analytics companies.

Although somewhat accurate, this method may be slightly outdated and doesn’t account for current market conditions, which, as we know, have significantly changed since the outbreak of Covid-19 in 2020. Standard methods may not give significant weight to new businesses with missing credit scores or even those who accessed crowd-funding methods to start their business, making it challenging to get a clear picture using traditional means.

2. Custom algorithms

Of course, another way to calculate credit risk is to develop a fully customized algorithm for this purpose. This will be able to account for all eventualities deemed relevant to your business and address any gaps in credit scoring processes. For example, you may even be able to tailor the algorithm to your business area, i.e., tech start-up loans or fast-food provider loans, and account for any peculiarities of the business.

At the same time, this can be an expensive solution as it will require qualified staff who are able to manage the algorithm and monitor it to ensure its correct functionality.

3. No-code AI/ML tools

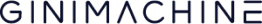

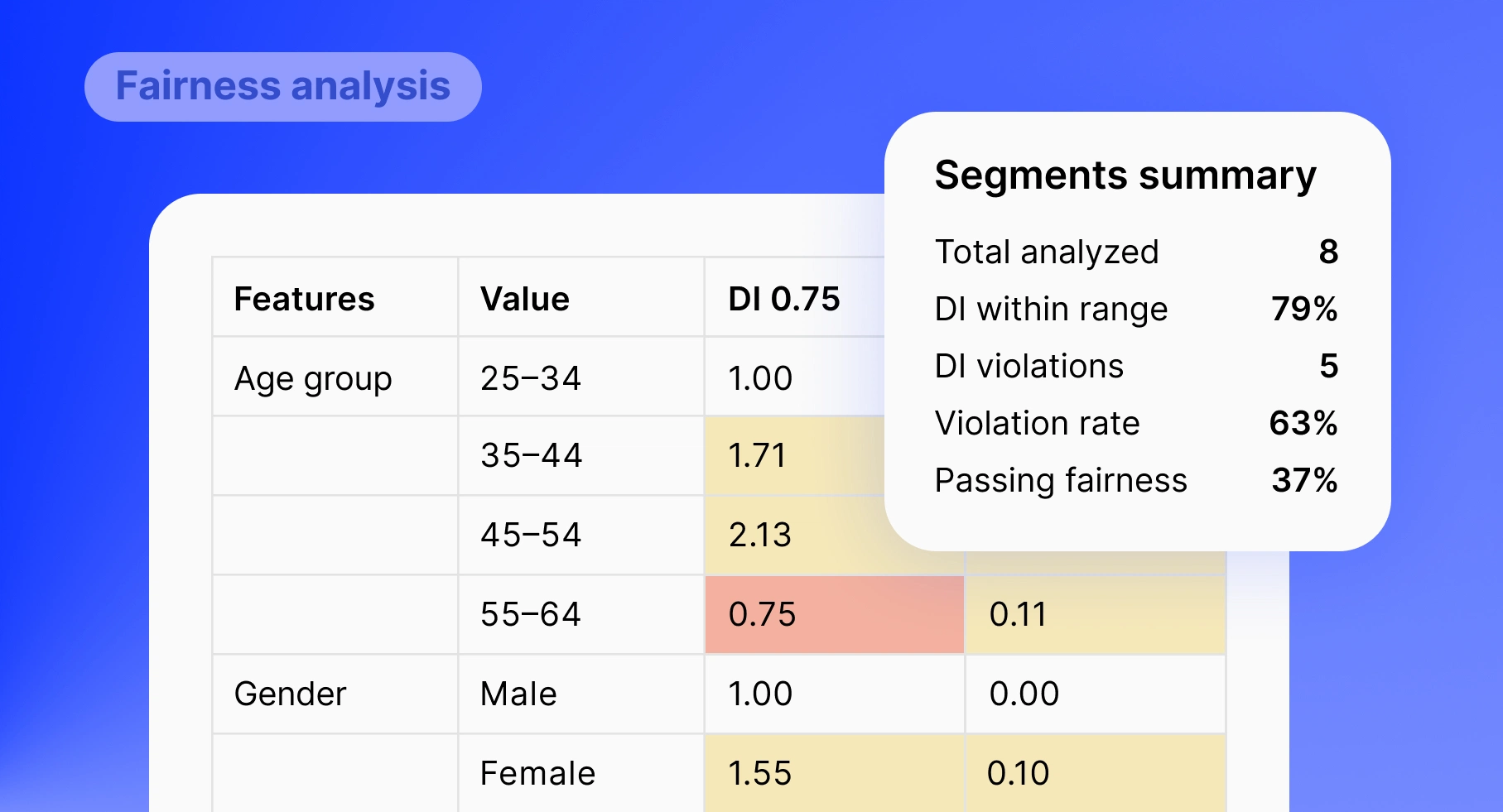

Consider this the golden middle. No-code AI/ML tools, such as GiniMachine, allow lenders to undertake business credit scoring without compromising on custom features, such as taking account of business specifics. For example, tools like this one can be adjusted and adapted to operate for the company’s needs and client base, taking into account all relevant factors and ensuring a lower level of risk.

Many can also be integrated into a company’s current software toolkit, so there is no need to reinvent the wheel. Instead, the onboarding process becomes simpler and implementation much faster.

Why may you need to upgrade your corporate credit scoring models?

The business has changed so much in the last few years, with new technologies being added all the time, so much so that it can be hard to keep up. This is likely the case for your clients as well, meaning even as they are applying for that essential loan, their needs are evolving.

By upgrading your current business credit scoring models, you’ll be better able to keep tabs on market changes and offer competitive credit rates. To keep ahead of the market, it’s essential to monitor all the traditional data and additional data types, such as:

- Behavioral data—the latest spending/saving data from the company. This tells you a lot about their processes and risk appetite within the business.

- Socio-demographic data—for example, you may take into account their audience and its level of affordability when it comes to available cash to purchase from the business.

- Psychological data—how has this company and its leadership team behaved with credit in the past? How does their lending history look?

Armed with this info, it becomes more possible to assess risk accurately and fund SMEs effectively.

Next steps for creating a business credit scoring plan

For any lending company on the market today, it’s essential to develop a comprehensive lending strategy, complete with a medium and small business credit risk plan. Although this task may initially seem complex, by onboarding the right help at the beginning, it can become more straightforward, as risks can be dealt with gradually and processes implemented at an early level to ensure maximum success. Whether you choose to stay classic or go for an upgrade, it never hurts to explore your options and evaluate the effectiveness of your current strategy before making any decisions.