Traditionally slow to adopt new technologies, preferring tried and tested methods, the perseverance of brick-and-mortar banks has been tested over the last couple of years. With fintechs continuing to grow and build trust worldwide, banks no longer have the option to stand by and observe how the industry will develop. The time to act is now, and here’s how AI in banking could be the solution.

Why Does AI in Banking Matter?

Today, estimates show that almost 90% of Americans now use a fintech firm. This growing popularity is no accident. Coming off the back of the coronavirus crisis, which disrupted all face-to-face services, advances in technology in the last two decades, and wedged between financial crises—2008 and the one yet to come—banks have been dealt a challenging hand. How they play their cards will define the future of banking in the next decade.

But why is now a crucial time in particular for brick-and-mortar banks? Well, that’s because big changes are truly afoot, and the cards favor the flexibility that fintechs offer, as opposed to the stalwart march of banks.

Looking at the indicators, we can see that trust in fintechs is also increasing. Their share prices in the wake of coronavirus have fully recovered. Meanwhile, traditional banks are recovering at a slower rate—not quite there yet. This is the first time that banks have truly started showing vulnerability.

In addition, over 40% of decision-making executives in traditional finance have a fintech account. Indicating immense interest, if not support, for their supposed competitors.

How AI in Banking and Financial Services Can Change Everything

While at the moment, the odds seem to favor fintechs and their market flexibility, that does not mean that there’s no time for banks to adjust their strategy and focus on future market needs. But how to get there? Here are three steps for those thinking of how to adopt AI in the banking and services sector.

Step 1: Set priorities

It’s impossible to do everything at once. That means that setting priorities is priority number one. The first part of this step is all about knowing which areas your competitors excel in, and which your customers value most.

When it comes to fintechs, users often state three top criteria where fintech dominates over banks. These are digital experiences, better rates and prices, and convenience. Armed with this knowledge, it’s now time to look closer at what this means for your particular bank.

Analyze your client base and their specific needs. It’s likely that you’ll already have a lot of data available for this purpose already. What’s most important here is knowing how to work with it. Many choose to start their AI and Machine Learning in banking journey right here and focus solely on utilizing Big Data to get results. While this is a crucial step, it doesn’t have to end there. Such data can be useful for forming Step 2.

Step 2: Creating capabilities

Now that you know the data, it’s time to look within your organization and explore which areas are primed for development. These are your opportunities for growth. Perhaps you noticed an ineffective payment system that needs upgrading, software that could be better integrated, or even a more efficient way to complete the lending process—take note.

But this stage isn’t just about looking for things to fix. It’s also about noting the resources you already have. In many cases, this may be your team. As the advocates of your business, they will be the frontliners who will drive future changes. By identifying reliable human resources within your team and making them change champions, you can increase the impact of technology adoption.

Step 3: Developing a sustainable strategy

Now you know your organization’s strengths, weaknesses, and resources, it’s time for step 3—transforming it all into a functional strategy plan. This should take into account the who, what, where, why, why, and how your team plans to adopt AI in banking and why it matters for your organization.

For example, while all banks may target a similar market or demographic, how they plan to interact with AI technology will differ, and so too their strategy. In this case, it’s vital to look at:

To what degree the bank wants to be technology-driven?

Which elements of technology do clients truly value?

How competitive is the bank today and where do they want to be tomorrow?

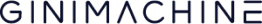

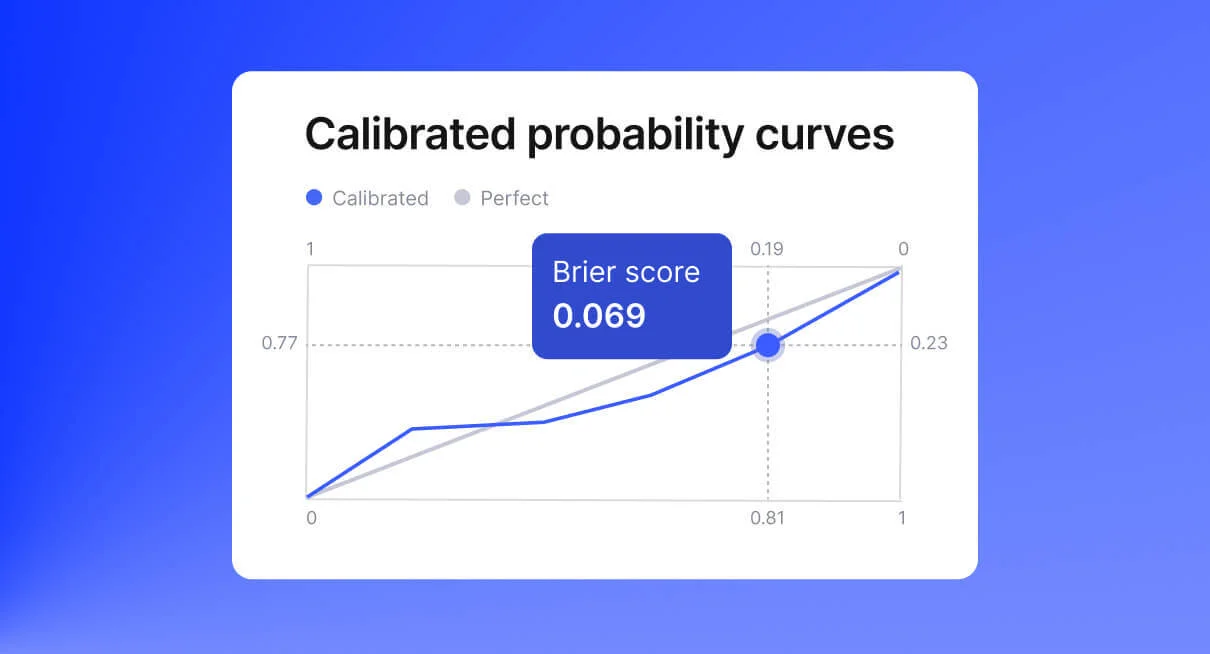

From there, you can decide which specific tools you will utilize to enhance your business. For example, your team may choose to optimize its lending strategy. In this case, onboarding a tool, such as GiniMachine, could help in automating and optimizing the lending process at all stages—onboarding, collecting, risk management and more—to ensure the best solution for both client and bank.

Will AI in Banking and Financial Services be the Future?

There is little doubt that AI technology will continue to find its usage in the financial sphere. Current uses are expanding across the world, with many traditional brick-and-mortar institutions choosing to explore newer and more modern solutions for their financial brand challenges. That said, AI is an expansive technology and can encompass everything from checking and rechecking credit scores for risk assessment to following up on collections due.

As we move into the future, we can only be certain of one fact—massive changes are coming to the financial world.